A value-added tax (VAT) is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale. The amount of VAT that the user pays is on the cost of the product, less any of the costs of materials used in the product that have already been taxed. In some countries its known as a goods and services tax (GST), is a type of tax that is assessed incrementally.

Note that

1. When the checkbox under Charge VAT? option above is not ticked, no VAT will be charged on that transaction .

2. Also when the option Charge VAT is ticked the system will always remind the user at login to set the VAT General Ledger accounts if they are not set.

3. Also ensure that the VAT to be charged has been defined under Support Files/VAT rates for the system to levi VAT on the specified charge categories.

4. VAT can be charged by products.

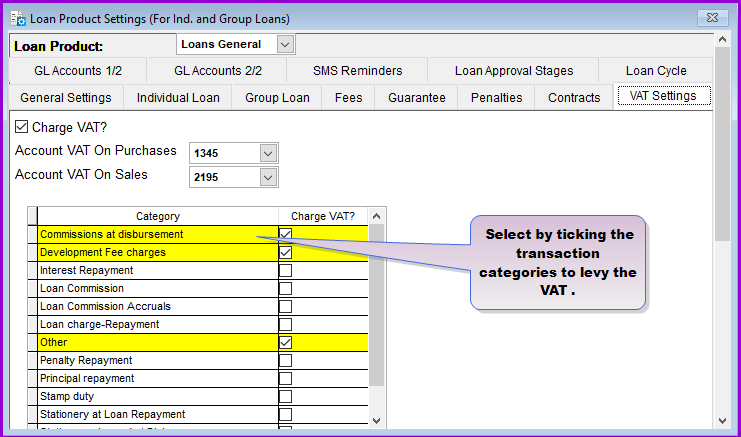

To get here, go to menu System/Configuration/Loan Product Settings/VAT Settings. The VAT page looks as follows:

- Charge VAT?: Tick this check-box if you are to charge VAT on any specified transaction categories.

- Account VAT on Purchases: Select the GL account for booking the VAT on purchases (Input VAT) from the Account VAT On Purchases drop down list e.g., "1345".

- Account VAT on Sales: Select the GL account for booking the VAT on sales (Output Vat) from the Account VAT On Sales drop down list e.g.,"2195".

- Category: This column shows the different transaction categories that can be charged with VAT in Loan Performer.

- Charge VAT?: Tick the check box for the different categories upon which VAT should be charged.

Click on the Save button to save the changes and on the Close button to exit the menu.